Tips for Buying and Selling Coins

A quick guide to investing and collecting.

If buying and selling coins have sparked your interest, consider why you’re venturing down the road of collecting. Do you want to collect coins only for the thrill of it, or are you interested in making a financial investment for your future? Perhaps both? This week, ONR offers a quick guide to an age-old pastime.

Collecting vs. Investingcoin collecting, coin investing

While some don’t see the difference between collecting and investing, there are differences. Some coin enthusiasts build their collection of rare or numismatic coins because it’s an exciting hobby like treasure hunting. While certain coins are known to outperform others financially over time, a collector may not factor this into their decision of which coins to add to their collection. They simply buy what they love. Others see coin collecting as a financial investment, much like buying real estate. These individuals will focus their purchases on coin types and issues most likely to increase in value over time. Still, others may buy coins mostly because they enjoy collecting them, but at least want to be sure that they are buying coins that are likely to increase in value over time. Certainly all collectors and investors also want to be confident that they are buying quality coins at fair prices. ONR is here to help everyone with their collecting and investing needs. Our experts will not only help you to select the highest quality coins for your collection, but can make specific recommendations to the investor based on historical market data about which coins hold the best investment potential.

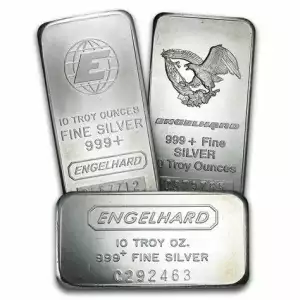

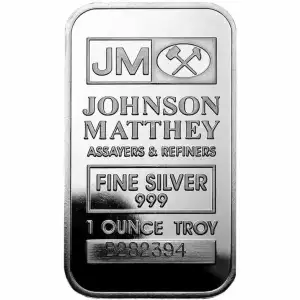

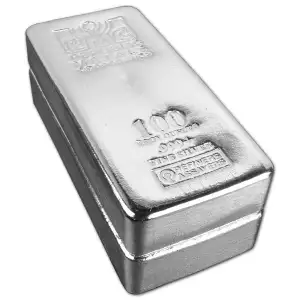

Bullion Coins vs. Numismatic Coins

This is an often-misunderstood topic for those new to coin collecting. Simply put, bullion coins are those coins made of silver, gold, platinum, or palladium whose value is largely determined by their metal content and nothing more. Numismatic coins on the other hand, although often made of these metals, have a collectible value above and beyond their metal content due to their history, rarity, and condition. ONR recommends a blend of both bullion coins and numismatic coins for individuals looking to establish a tangible-asset investment portfolio.

Investment

Both bullion coins and numismatic coins can make good investments. Assets like these have increased in value over time and are always attractive to international markets. They are often in high-demand, especially during a crisis. Another factor to consider is, unlike an electronic portfolio of financial investments, you can physically hold your silver and gold coins in your hand, giving you guarantee of ownership as well as privacy when storing and transporting these assets.

Treasure Hunting

Coin collectors are those in search of numismatic coins. Unlike investors who may be only interested in ROI, coin enthusiasts are often modern day treasure hunters in search of rare coins that will add symbolic and historical value to their collection. Much like collecting art, coin collecting requires good knowledge of the pieces you are buying, to avoid coins that are counterfeit, off-quality, or overpriced. ONR is your trusted coin dealer that will help you navigate the coin buying and selling process while keeping it as safe, fun, and exciting as possible.

ONR is one of Pittsburgh’s top coin dealers and authorized precious metals distributor in gold, silver and platinum bullion products. Visit us for all your buying, selling and collecting needs! Located in the heart of Pittsburgh’s Shadyside District, call or visit us anytime – 844-667-2646!