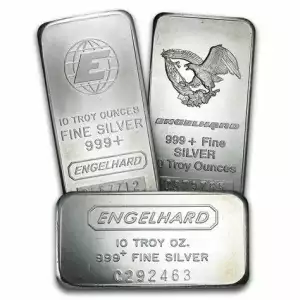

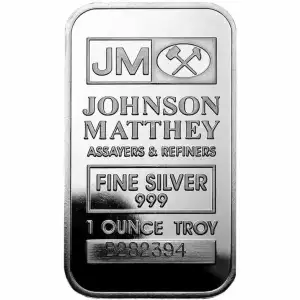

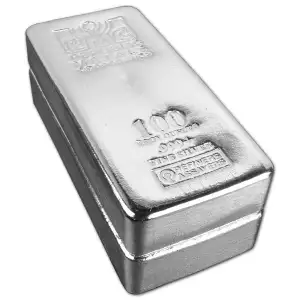

Buying gold, silver and other precious metals in bullion is a good way to invest in something that will always retain value. Bullion is the purest form of gold and silver you can purchase, and unlike your investment portfolio that resides within stocks, bonds or money market accounts, bullion is a physical asset you can hold in your hand. From a market perspective, if the value of a dollar goes down and the market tanks, your portfolio could not only deplete quickly, but anything left may not be worth as much as you invested. In fact, bullion investments are often purchased as insurance during economic crisis because gold and silver have been used to pay off debt throughout the world’s market for centuries.

As investors try to predict the ebbs and flows of national and international markets, ONR explains why purchasing bullion is a simple investment you may want to consider.

Sales-Tax Free: In Pennsylvania and in many other states, there is no sales tax on bullion and collectible coins. This presents an opportunity to purchase tangible investments at a relative discount, unlike other investments such as fine art, jewelry, wine, and vintage automobiles, which are all taxable.

No Investment Manager Needed. Asset management companies, or AMC’s, provide individuals hoping to invest their money properly with licensed investment managers. These managers work hard to allocate your assets and diversify your portfolio, but they earn their income through service fees and commissions from trades made with your money. Owning bullion doesn’t require any of this as you can keep your gold and silver with you always – even travel with it. While keeping it somewhere secure is best practice, even any storage fee for this service is nothing compared to what you’re spending with an AMC.

Politics: National and international crisis can pose a negative impact on the market. While the economy and markets may fluctuate, and the value of the dollar may change, precious metals are always valuable and may be worth even more during turmoil.

Cyber-terrorism. In today’s world of internet-based-everything, cyber-terrorists are always looming. While cyber-security is constantly battling these menaces, it’s an unfortunate reality we consider when dumping our assets into a market or AMC that could be compromised. When you own gold or silver, the threat of cyber-terrorism isn’t a factor to your investment.

In the end, owning gold, silver or any precious metal is an investment worth considering. It’s a tangible piece of equity you can hold in the palm of your own hand. It will always retain value and can be passed down for generations. If you’re looking to protect yourself or want some sort of insurance during turmoil, investing in gold or silver is something to think about.

ONR is Pittsburgh’s premier source for rare coins and precious metals like gold, silver, and platinum. We offer appraisals at our Shadyside location or we can complete a private consultation in your home or office. We are accredited by various numismatic organizations and can provide quality services to collectors and investors, whether a novice or a seasoned expert. Call us today for all your collecting and investing needs – (844) 667-2646.