The Evolution of Paper Money

Paper money was first printed in China around 700 A.D. during the Tang Dynasty, with small, local issues of paper notes. Paper money was developed because merchants and wholesalers sought to avoid using the heavy and cumbersome copper coins in large commercial transactions. By 960, the Song Dynasty issued jiaozi , the first widely circulating notes (shown at left). These notes bore a promise to redeem later for some other object of true value, usually coins struck from precious metals.

Banknotes did not appear in Europe until the 14th century, deriving their name from the Italian nota de banco , or "notes of the bank." These notes originally recognized the right of the holder to collect precious metal deposited with bankers in exchange for the note. By the end of the fourteenth century paper money circulated in every part of Europe, as well as Italian city-states outside of Europe.

In the early 1690s, the Massachusetts Bay Colony was the first of the Thirteen Colonies to issue permanently circulating banknotes. Various types of paper money were eventually issued by all colonies as a means of compensating for the coin shortage that was plaguing the growing nation. Later, in 1775, the Continental Congress authorized the issuance of paper money to finance the Revolutionary War. These notes were known as Continental Currency and were redeemable in Spanish Milled dollars.

After the constitution was ratified, the U.S. mint was established and it began producing the first coins in 1793. From this point until 1861, the United States did not find the need to issue paper money as we know it. During this interim, however, the government occasionally issued Treasury Notes to meet the drain on the Treasury due to war, financial stress, and sometimes panic. These Treasury Notes were actually promissory notes that bore interest and which the Treasury redeemed as quickly as possible. Some of the events that brought forth these notes were the War of 1812, the Mexican War of 1846, and the Panic of 1857.

During the later part of this interim period (1793-1861), various states granted charters to many private banks authorizing them to print their own paper money. These notes were supposed to be backed by money on deposit at the bank, but since there were none of the restraints on banks as there are today, these banks went bankrupt with alarming ease. When this occurred, the paper money they issued became worthless and a great deal of financial hardship fell upon banknote holders.

Shortly after the start of the Civil War, the United States found itself desperately in need of money to finance the war. Accordingly, Congress passed the Act of July 17th, 1861 which permitted the treasury to print and circulate 60 million dollars worth of paper money. These first notes were known as Demand Notes and were followed by Legal Tender Notes in 1862. After the Civil War, the United States continued to issue paper money that was backed by gold or silver until 1933. After this date, all forms of paper money were redeemable only in silver. By 1968, however, United States paper money was converted to fiat currency , or money that lacks intrinsic worth and has value only by government decree.

"We are in danger of being overwhelmed with irredeemable paper, mere paper, representing not gold nor silver; no sir, representing nothing but broken promises, bad faith, bankrupt corporations, cheated creditors and a ruined people."

-- Daniel Webster, 1833.

The Foundations of Notaphily

Notaphily refers to the study and collection of paper money, banknotes, bank checks, and other printed forms of currency. Those who study such money are referred to as notaphilists . Like coins, paper money has been collected in some manner or another since it was first printed in the 7th century. However, because the issuance of metal coins predates paper money by well over 1,000 years, the field of paper money collecting is clearly a younger field than coin collecting. This difference applies to United States money as well. Coins were produced by the federal government starting in 1793, but reliable paper money was not issued regularly until 1861. U.S. coins thus had a 70 year head-start over U.S. paper money. As discussed above, the individual states did issue paper money prior to 1861 and the federal government occasionally issued Treasury Notes in periods of financial distress. However, the state-issued money frequently lost its value quickly, so U.S. citizens were always somewhat suspicious of paper money. For these and other reasons, paper money was not looked upon as favorably by early collectors until many years after its introduction.

The systematic study and collection of paper money for its rarity and historical value did not begin in the United States until the 1940s. By the 1950s, Robert Friedberg had published Paper Money of the United States, a landmark text which provided an organized classification system for all U.S. notes for the first time. This text, now in its 21st edition, is widely accepted among collectors and investors today and is still considered the standard reference work on United States Paper money. It is available for purchase through Olevian Numismatic Rarities.

Today, paper money is still a smaller field than coins, but interest in this area has been growing exponentially. Many numismatists now collect both coins and paper money, and there are more specialists in paper money now than at any time in history. The rising demand for paper money over the past decade stems partly from increased recognition of the true scarcity of many American paper money issues when compared to their contemporary coin counterparts. The designs of old U.S. paper money represent the best work of the best engravers of the 19th and 20th centuries. For this reason, U.S. banknotes have aptly been referred to as "masterpieces of the art of engraving," and are absolutely beautiful enough to rank with other fine works of art.

As U.S. collectors compete for the acquisition of these rare and beautiful notes, the price of U.S. paper money continues to rise substantially, with many notes now selling for over $1,000,000. However, prices for paper money specimens are still relatively cheap when compared to coins of similar rarity. Therefore, today may represent a true window of opportunity for starting a paper money investment portfolio that has the potential for unprecedented profits in the next 10-20 years. The next section will elaborate on why paper money can be an excellent numismatic investment.

Rare Paper Money as an Investment

Introduction

Investing in rare paper money can be as profitable an enterprise as investing in rare coins for the well-informed investor. Indeed, most of the basic principles of investing in coins also applies to paper money, so we will not belabor them in the subsequent sections. After reading the section on paper money, you should be able to start investing in rare banknotes immediately, with the help of Olevian Numismatic Rarities. As with coins, the more careful you are in selecting a qualified dealer and making an educated evaluation of the coins you purchase, the greater will be your chance for a profitable investment. You have already made an important step in the right direction by choosing Olevian Numismatic Rarities as your supplier of paper money investment products. ONR is committed to helping you make educated decisions when building, maintaining, and liquidating your numismatic portfolio. The following section outlines the specific reasons why rare paper money is a great investment.

Reasons to Invest in Rare Paper Money

1. Rare Paper Money Demonstrates Top Investment Performance

Over the past 30 years, paper money collections have produced substantial long-term profits for their owners, often as good or better than coin investments. In part this is due to the scarcity of many paper money issues and increasing interest amongst numismatic collectors. Now may be an excellent time to diversify into rare paper money (and coins) to potentially tap in to the remarkable gains enjoyed by investors in this area for decades. Selected segments of the rare paper money market have performed better than others, and Olevian Numismatic Rarities will help you select these top performing paper money investments for your portfolio.

2. The Demand for Rare Paper Money Exceeds the Supply

If old coins are rare, old paper money is even rarer. There are several factors that account for this disparity. Since the U.S. generally issued fewer banknotes than coins in a given year, the production of many types of paper money was dwarfed by the production of coins during the same period. In addition, the lifespan of circulating paper money is measured in months, whereas the lifespan of circulating coins can be measured in decades. Even though vast amounts of paper money have been produced, an overwhelming majority of it has been destroyed. Finally, paper money did not attract the same interest from numismatic collectors as coins did until almost 100 years after coin collecting became popular. Therefore, very few notes were ever removed from circulation and placed aside, leaving present day investors with a paucity of old notes in pristine uncirculated condition. Indeed, the best examples of many 19th century issues of paper money are graded Fine-12 or lower. Since the U.S. treasury no longer produces these historic banknotes, there is a finite supply that must be distributed amongst collectors and investors wishing to acquire a specimen. As with coins, some paper money specimens are unique, with only 1 example known to exist. Notes like these have realized six and seven figure prices at auction in recent years. As collectors and investors come to appreciate the true rarity of old banknotes, the trend of increasing demand against a fixed supply will cause prices for all forms of paper money to rise considerably. In summary, the demand for quality examples of rare banknotes is only expected to increase, leaving investors with a wide selection of potentially lucrative paper money investment options.

3. Rare Paper Money has Great Liquidity

With the advent of the independent paper money grading services like PCGS Currency and PMG, rare U.S. banknotes have become as liquid as rare coins. As with coins, thousands of certified notes are bought and sold electronically "sight-unseen," and thousands more are sold directly to collectors and investors at shops and public auctions. Therefore, the typical numismatic portfolio consisting of coins or paper money can be reasonably converted to cash when needed.

4. Rare Paper Money is Affordable to all Investors

Compared to other collectibles such as rare oil paintings, or investments like real estate, many rare U.S. banknotes are very affordable. Despite their record of consistent price gains and the multi-million dollar collections often sold at auctions, rare banknote portfolios with outstanding track records and promising futures are available in a wide range of investment levels. Olevian Numismatic Rarities will tailor your portfolio to your individual financial situation.

5. Rare Paper Money is a Private Investment

Again, like rare coins, paper money investments can be accumulated privately. Since banknotes are easily transported and because investors can take physical possession of their holdings, paper money is attractive to investors who wish to keep their investments confidential. No one will know what your numismatic portfolio is worth, or that it even exists in the first place. Furthermore, sale of rare United States paper money is not reportable to the Internal Revenue Service. Olevian Numismatic Rarities maintains strict confidentially with all clients and our team is always available to meet privately to discuss your investments.

6. Rare paper money is a Great Portfolio Diversifier

All investment professionals agree that an investment portfolio should be diversified if stability is your goal. Many financial advisors recommend that investors place 20-30% of their discretionary funds in tangible assets to achieve a properly diversified portfolio. Rare U.S. paper money is a great adjunct to coins and bullion in every numismatic portfolio. Like coins, paper money can be very useful in reducing the overall volatility of your investments because banknotes also tend to perform well when more traditional investment vehicles are performing poorly. Thus, the diversity afforded by adding paper money to any preexisting investment portfolio can provide investors with added security and peace of mind.

Determinants of a Banknote's Value

Introduction

The same factors that influence the value of rare coins will influence the value of paper money, with the notable exception that paper banknotes have no intrinsic value. Thus, face value and numismatic value remain as the two chief determinants of a banknote's value.

Face Value

The law has required that every banknote issued by the Treasury bear a statement of value, called the face value , which is denominated in U.S. dollars. Like coins, all standard issue U.S. paper money produced after 1861 still remains legal tender for the purchases of goods and services. Of note, silver certificates, gold certificates, and other special forms of paper money are no longer redeemable for precious metals.

From the Continental Currency of the 18th century to the high-denomination Federal Reserve Notes of the 20th century, the United States has issued paper money in practically every denomination imaginable. Indeed paper money of the 1770s came in $1/6, $1/3, $3, $7, $40, $55 and dozens of other unusual denominations. During the second half of the 19th century, "fractional currency" was issued that bore values of 3 cents, 5 cents, 15 cents, 50 cents, and other denominations under $1 dollar. Later, Federal Reserve Notes were produced in denominations as high as $500, $1,000, $5,000, $10,000, and even $100,000.

From an investment perspective, the face value of a banknote provides a definitive price floor. Even if numismatic demand for a particular bank note somehow disappeared, a 1934 series $500 Federal Reserve Note would still be redeemable at any U.S. bank for its face value. Here again, no stocks can offer this built in face value and the possibility of losing 100% of your investment capital is never completely eliminated.

Numismatic Value

The primary determinant of a rare banknote's value is the collector value, not the face value. This is clearly the case for state-issued notes and other obsolete paper money that no longer has a face value. As with coins and other collectibles, the value of a rare note is established in a free market by investor and collector activity. The size and intensity of that activity is influenced by three major factors: rarity, condition, and demand.

Rarity

The rarity of a particular banknote is a strong predictor of its numismatic value. Because many collectors and investors prize the scarcer issues and target them for acquisition, the rarest notes frequently command the highest prices. As discussed earlier, certain issues of paper money are very rare today because either relatively few notes were printed or because most of them have been destroyed. Like coins, rarity of banknotes can be of two kinds—rarity of design and rarity of condition. The rarity of design is the most important since the notes involved exist in only one or two varieties, whereas notes of more common designs may have numerous varieties of seals or signature combinations, making such designs easier to acquire. Since collectors frequently strive to acquire at least one example of every design, those notes of rare design often sell for high prices. Rare designs include all Interest Bearing Notes, Demand Notes, and National Gold Bank Notes.

Rarity of condition refers to notes that are rare in high grades, but may be relatively common in lower grades. This situation often exists when very few, if any, examples of new notes were saved by the collectors of yesteryear. All Legal Tender Notes of 1869 and National Bank Notes of the First Charter Period (1863-1875) are examples of notes that are relatively common in circulated grades but quite scarce in uncirculated condition.

Only recently has the rarity of old U.S. paper money truly come to be appreciated. Reliable printing figures exist for most issues of paper money, and now fairly accurate estimates of remaining numbers have been published. Paper money certification services maintain detailed population figures for all notes certified by their company in each grade, similar to the population reports for certified coins.

Condition

The second factor that influences a banknote's numismatic value is its condition. As with coins, quality is a major consideration. The best examples of banknotes are in the greatest demand and bring the highest prices. The experienced numismatist thus wants to purchase the best example available, or at least the best that can be afforded. This dictates the need for a classification system for determining the grade , or level of preservation, of an individual banknote. Paper money is graded on essentially the same 70-point scale as coins, with 1-59 representing circulated grades and 60-70 representing uncirculated grades.

Circulated Notes

Circulated notes have suffered damage as a result of use in commerce or mishandling. The overwhelming majority of U.S. notes ever printed have been circulated. The more wear, tears, folds, stains, etc. these notes have, the lower their grade. The circulated grades in increasing order of preservation are Poor (P-1), Fair (F-2), About Good (AG-3), Good (G-4), Very Good (VG-8), Fine (F-12), Very Fine (VF-20), Extra Fine (EF-40), and About Uncirculated. (AU-50). These are the same adjectival grades given to circulated coins.

Uncirculated Notes

Uncirculated notes are those which have been printed but show no signs of ever having been used in circulation. They are assigned grades ranging from Uncirculated (Unc) 60 to 70. Unc-60 to Unc-70 is analogous to the Mint State-60 to Mint State-70 used to describe uncirculated coins. Uncirculated specimens have the best eye appeal, command the highest premiums, and are of particular interest to collectors and investors.

Eye Appeal

The technical grade of paper money not only takes into account the degree of wear, but is also influenced by other attributes, including paper quality, front and back alignment, evenness of margins, and ink quality. Whenever possible, investors should choose only those notes with above average eye appeal for the grade, as these notes are in the highest demand and bring the highest prices.

As the grade is a chief determinant of a banknote's value, it is useful for investors to become familiar with grading standards. However, no grading experience is needed to start investing, as Olevian Numismatic Rarities will assist you in acquiring remarkable banknotes of the highest grades at the best possible prices. If you do wish to learn the details of paper money grading, please ask Olevian Numismatic Rarities about the available reference texts.

Professional Paper Money Grading Services

Paper money can be submitted to independent grading services just like coins. For a fee, these firms examine your banknote, certify its authenticity, and assign a consensus grade based on at least three expert opinions. If genuine, the note is then sealed in a hard, clear plastic currency holder with its grade and certification number displayed. These provide physical protection for the note and safeguards against tampering with the grading documentation. Two leading independent paper money grading firms, PCGS Currency and Paper Money Guarantee (PMG), have become widely recognized for their objective grading practices and high industry standards. They continue to provide reliable consumer protection for banknote collectors and investors and preserve the integrity of the paper money industry.

Consider Certified Rare Banknotes for Investment

Olevian Numismatic Rarities strongly recommends that investors purchase rare paper money that have been certified by a leading certification service. Not only do certified banknotes make numismatic investments safe, these services publish monthly population reports that detail the number of notes that have been certified in different grades and issues, which serves as a guide for determining the scarcity of graded notes. In addition, certified notes are more readily sold, with thousands of certified notes sold daily "sight unseen"—a testament to the trust the industry places in certification services. With a guarantee of authenticity and the exact grade printed on the note's label, investors need only to reference the latest price guide to determine its market value.

Demand

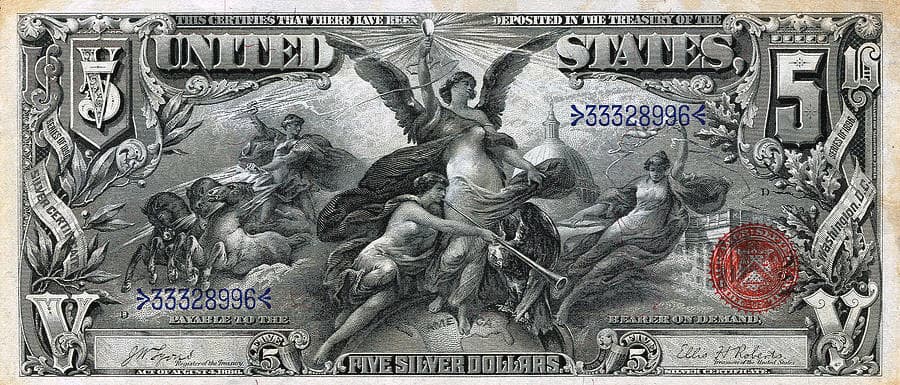

The third and perhaps most important factor that influences a banknote's numismatic value is its demand. The level of demand varies between issues, with some notes appealing to a great numbers of collectors and investors. Demand for rare paper money has been increasing steadily in the past 20 years, such that even notes which were once common are now rare. Like coins, certain banknote series are in more demand than others. The 1896 "Educational Series" of silver certificates are frequently cited as the most detailed designs of all U.S. paper money and are highly sought after by collectors. The extraordinary beauty and historical appeal of these notes has caused such a consistent demand for them for the past 40 years that investors are expected to enjoy great returns on these notes for a long time to come. Since notes in high demand tend to be more liquid and increase in value faster than less popular issues, Olevian Numismatic Rarities generally encourages investors to focus their attention into these more popular series.

With a better understanding of what determines a rare banknote's value, we will now turn our attention to specific strategies for investing in paper money that are more likely to produce substantial long-term profits.

Strategies for Investing in Rare Paper Money

Introduction

The basic strategies for investing in rare paper money is no different than for investing in coins. In both fields, it is important to think like a collector when building a portfolio and is often financially rewarding to build sets of related items.

Think Like a Collector

At the very least, an investor must learn to think like a collector when choosing pieces for their portfolio. This is because collectors represent the most knowledgeable clients acquiring paper money. They frequently acquire specimens in a highly systematic fashion, selecting historically important notes that are in great demand and of the highest possible conditions they can afford. Like coin collecting, paper money collecting is as much of an investment strategy as it is a hobby, and for this reason collectors enjoy the greatest investment returns. As a lifelong collector himself, Dane C. Olevian can offer this important perspective when assisting you in the selection of banknotes for your investment portfolio. One great approach is to build specific "sets" of bank notes, which is described in more detail the next section.

Set Building is an Excellent Approach to Investing

Paper money Sets Explained

There are many fun and profitable ways to collect banknotes, but one particularly rewarding strategy is set building . Banknote sets contain specimens that are related to one another in at least one way. There is virtually an endless variety of interesting and investment-worthy sets available to collectors and investors of all personal tastes and price levels. Some sets, however, tend to be more appropriate for investors than others, and Olevian Numismatic Rarities can make specific recommendations in this area. Examples of sets that make excellent investment ideas include series sets, signature sets, and origin sets.

Series Sets

Unlike coins, the date printed on a banknote does not necessarily reflect the year it was printed and issued. This is because paper money is issued in series rather than by date like coins are. Since series often span a period of many years, it is often not possible to determine the exact year a note was printed. However, the year a note was printed can be narrowed down by considering the two signatures of government officials which appear on the note. These two signatures are usually either of the Register of the Treasury and the Treasurer, or the Secretary of the Treasury and the Treasurer. For example, a note which bears the designation "series of 1899" and has the signatures of Elliot and Burke must have been produced between November 21st, 1919 and January 5th, 1921—the period in which these two signers held office concurrently.

A series set, therefore, will contain one of each note type, denomination, seal design, signature, etc. that appeared during a particular series. The popular 1896 "Educational Series" silver certificates mentioned above contains 3 denominations of notes, including a 1, 2, and 5 dollar silver certificate. The one and two dollar notes each have two different signature combinations, whereas the 5 dollar note has 3 signature combinations. Thus, a full 1896 Educational Series Set requires a total of 7 notes for completion. Series sets are a great way to start assembling a small paper money portfolio that can easily be expanded later. Once you finish one series, you can move on to a different series until you have completed all series of United States Paper Money—a formidable endeavor indeed!

Signature Sets

Signature sets attempt to collect all the notes which bear a particular set of signatures. There have been about 80 different signature combinations on U.S. paper money since 1861. For instance, one signature set might contain an example of every note type signed by both Register of the Treasury John Allison and Treasurer F. E. Spinner, who held office concurrently from April 3rd, 1869 to June 30th, 1875.

Origin Sets

Origin sets are composed of notes bearing the name of a particular city or bank, such as that of a National Bank Note. National Bank Notes form the most plentiful and extensive series of American paper money. Passage of the National Banking Act of 1863 enabled the government to grant charters to private banks that allowed them to print and circulate their own paper money. These National Bank Notes were issued by thousands of banks in the United States from 1863-1929. An origin set of National Bank Notes will contain one example of all the notes issued by a particular National Bank, such as the Mellon National Bank of Pittsburgh, PA.

A Word about Size

From 1861-1929, most issues of U.S. paper money measured 3.125 by 7.5 inches in dimension. These notes are referred to as "large-size" currency and are more colloquially known as "horse blankets." As the demand for paper money exploded in the 20th century, the United States government realized that millions of dollars could be saved if paper money was reduced in size. In 1929, banknotes were reduced to a dimension of 2.6 by 6.15 inches—the familiar size we know today. These notes are now referred to as "small-size" currency.

Investing in Rare Paper Money: A Summary

We have briefly examined the history of paper money and reviewed the most important principles of notaphily. We have also looked more closely at why rare banknotes make exceptional investments and at some of the preferred ways to invest in paper money. investors turn to rare coins and paper money when building a tangible asset investment portfolio. For the ultimate in numismatic portfolio diversification, however, many investors add bullion products to their rare coin and paper money assets. Given that the most popular bullion products are coins, there is considerable overlap between coin and bullion investments. However, the emphasis on the latter is not investing in the collector value of bullion coins, but instead on their intrinsic metal value. Indeed, most bullion pieces are only worth a marginal premium above their melt value. Please read our coin and precious metals educational pages to learn why they too have a place in every investor's portfolio.